3 Minutes

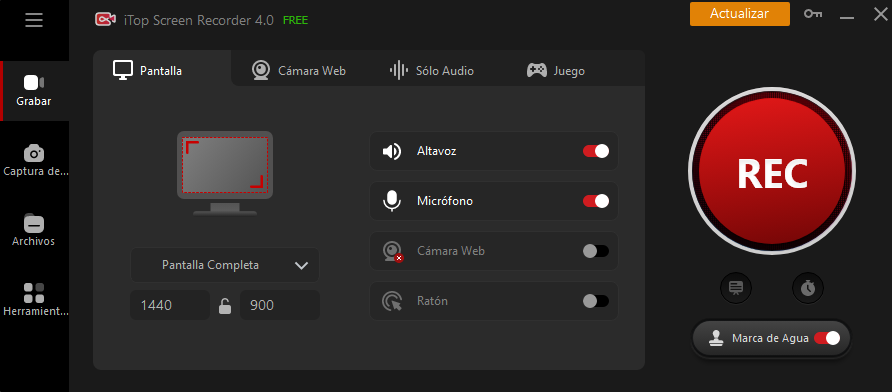

How to Change Your Voice when Recording

Introduction In the realm of screen recording, achieving impeccable audio quality is often as crucial as capturing high-resolution visuals. iTop Screen Recorder not only excels in providing a seamless screen recording experience but also...

Read More